Friday, June 29, 2007

Update AVR PEIX

According to the Scientific American, nearly 93 million aces of corn were planted this spring creating the largest planting since 1944. Their is however, some concern over the possibly of an ethanol glut, which could hurt ethanol producers margins if supply outstrips demand. While this is a real possibility, one must remember that oil is now trading near $70 per/barrel making ethanol as a automotive fuel source all the more appealing.

Corn prices and their effects on ethanol producers profits has largely been the catalyst for the sectors multi-month pps collapse. The sentiment however could be changing as several industry leaders such as VSE, PEIX and USBE apparently broke out on above average volume last Friday after the announcement of favorable legislation.

Posted by

CNL

at

12:16 PM

![]()

Thursday, June 28, 2007

Book Reviews and Investing

Starting shortly I will begin including book reviews as a regularly scheduled addendum to the Speculator. As perpetual students of the markets it is essential for investors to continually refresh our perspectives regarding the medium in which we trade. The reason for this is quite simple. The financial markets are dynamic and ever changing. This is made keenly apparent if one views the ebb and flow of a trending market. Even in a readily apparent bull market, surges and counter movements are expected. These movements and reactions are also apparent within the global economy as supply and demand imbalances oscillate between extremes, agitating prices along the way. As investors it is much to easy to remain stuck in the past as we dwell on our previous inadequacies and rudimentary trading mistakes. While the past does hold wisdom from experience, it is this and nothing more. Learn from one's missteps, and practice precision more precisely in the present.

Starting shortly I will begin including book reviews as a regularly scheduled addendum to the Speculator. As perpetual students of the markets it is essential for investors to continually refresh our perspectives regarding the medium in which we trade. The reason for this is quite simple. The financial markets are dynamic and ever changing. This is made keenly apparent if one views the ebb and flow of a trending market. Even in a readily apparent bull market, surges and counter movements are expected. These movements and reactions are also apparent within the global economy as supply and demand imbalances oscillate between extremes, agitating prices along the way. As investors it is much to easy to remain stuck in the past as we dwell on our previous inadequacies and rudimentary trading mistakes. While the past does hold wisdom from experience, it is this and nothing more. Learn from one's missteps, and practice precision more precisely in the present.

I mention the present as apposed to the future, because traders often make the mistake of actively trying to predict the future. This is yet another inappropriate way to view trading. While some traders have proving track records of accurately predicting the future, the vast majority of us will fail if we believe we can develop a talent to read the signs of the time. Instead of trying to predict future price movement, it is more appropriate to, "Look at the future as unknowable in specifics but foreseeable in characters."(Faith 48). Essentially, we must look at the future not in terms of prediction, but in terms of probabilities.

One method, if not the best method of improving accuracy is to constantly read and learn from experienced traders and investors. Whether we are reading Warren Buffet's personal favorite The Intelligent Investor or a more contemporary piece such as The Master Swing Trader, it is imperative for us as students to continually thirst for knowledge.

Faith, Curtis M. Way of the Turtle. New York: McGraw-Hill, 2007.

Posted by

CNL

at

2:10 PM

![]()

Wednesday, June 27, 2007

Update MVIS

Finally back from my short vacation. Hopefully, I will be able to devote more time towards my investing. Just did some initial charting tonight on MVIS partly because of the higher volume sell off. I don't know the reason for the move(warrant conversion?), nor do I really care due to my rock solid beliefs in the long term viability of this company. I will however say that the technicals have just got a whole lot more bearish. Despite the now tarnish chart, the fundamental story has now improved. The question is can longs handle Microvision moving in directions besides straight up?

BTW: During my post yesterday regarding PEIX I neglected to mention that I purchased the July $12.50 call options for $.65.

Posted by

CNL

at

1:13 AM

![]()

Monday, June 25, 2007

Update PEIX

I bought some July $12.50 PEIX calls. I have been on vacation the last week and have been seriously lacking with my editorials. Once I get back I will write up a detailed explanation. Above is the 5 day chart of the dominate ethanol stocks. PEIX seems to be holding its gains stronger than any other pure play. More on this later.

Posted by

CNL

at

11:46 AM

![]()

Friday, June 22, 2007

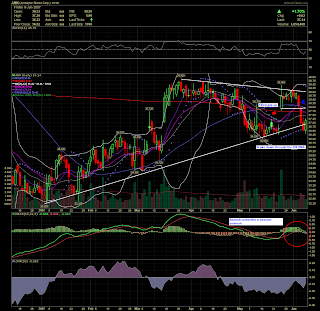

Update ADM AVR

I closed out my ADM September $30.00 put options at $.55, for a gain of 37.5%. Basically this transaction covered taxes and fees, essentially creating neutral trade. Late in the day I also initiated a position with Aventine Renewable Energy Holdings Inc.(AVR), by picked up some July $15.00 call options for $.65.

I am looking for continued favorable legislation next week as the House reviews the current energy Bill.

Posted by

CNL

at

1:20 PM

![]()

Thursday, June 21, 2007

Wednesday, June 20, 2007

Interesting Technical Formations.

All three composites, the NASDAQ, the DOW and the S&P are once again poised for a picture perfect double bottom. We saw the repercussions of this formation after the early March sell off and subsequent rally. A bottom was created followed by a rally which was unable to break resistance. Finally, a second bottom was formed followed by a higher volume rally which was able to break out through resistance, pushing the markets to new heights.

While the picture my appear similar from a technical vantage point, fundamentally the story is slightly askew. Bond yields continue to creep higher, economic growth is nearly grinding to a halt and pesky inflationary pressures wont seem to let up.

Posted by

CNL

at

11:47 PM

![]()

Tuesday, June 19, 2007

Cal Dive - A Surprisingly Undervalued O&G Service Company

As I have mentioned before, I am quite bullish on cylicical oil and gas service companies. More specifically those with deep water Gulf of Mexico exposure. Last September, Cheveron, Devon Energy and Statoil SA reported finding potentially the largest American oil deposit in a generation. According to a New York Times article, the find could hold anywhere from 3 to 15 billion barrels of oil. The only catch is that Jack No. 2 is located some 175 miles offshore, 30,000 feet below the gulf's surface, among formations of rock and salt hundreds of feet thick. With current United States's reserves at 29 billion barrels this discovery could potentially increase our proven reserves nearly 50 percent. Although this sounds spectacular in writing, the situation is slightly more complicated. This discovered came after nearly 2 years of drilling with the combined investments of 3 major oil companies. While this type of frontier oil drilling is possible with oil at $60 per/barrel, more exploratory drilling at record depths and pressures will be required to bring this oil the market. Even more daunting is that current US demand of 20.5 million bpd will drain this supply within two years.

This discovered came after nearly 2 years of drilling with the combined investments of 3 major oil companies. While this type of frontier oil drilling is possible with oil at $60 per/barrel, more exploratory drilling at record depths and pressures will be required to bring this oil the market. Even more daunting is that current US demand of 20.5 million bpd will drain this supply within two years.

Daniel Yergin, president of Cambridge Energy Research Associates noted that, Success at these depths in the Gulf of Mexico would facilitate ultra-deepwater exploration elsewhere in the world because it will have proven the technology and capabilities.

Aside from these integrated oil drillers and producers, companies set to perform well are the oil and gas service companies required to build, upgrade and repair existing and impending offshore rigs and piping.

Apparently this industry has already taken off, as evident by recent stock quotes, but due to an industry average P/E of 15.95, companies still look relatively undervalued with relation to estimated growth.

This company is however something of an enigma for it boost an impressive operating margin of 35% compared to the industry average of 16.6% and yet only trades at an affordable forward P/E of 10.3. Interestingly, the company is as also a subsidiary of Helix Energy Solutions Group Inc which effectively holds 61,000,000 of the company 84,000,000 outstanding shares. When one couples this with the nearly 4 million shares sold short, DVR could prove to be a highly volatile and lucrative investment as we gear up for yet another eventful hurricane season.

Going forward I plan to add to my existing July $17.50 call options holdings.

Posted by

CNL

at

7:10 PM

![]()

Monday, June 18, 2007

Update MVIS

I sold a portion of my MVIS shares at $5.47 today to cover my recent December $5.00 call options(see previous post). Nothing really has changed except for my leverage. Basically I converted a portion of my shares into options contracts. This will increase my exposure to MVIS. The main difference aside from volatility is with respect to expiration dates. My shares of MVIS will not 'expire' but the options can and will expire on their specific target dates unless I activate them or sell them prior to their specific dates.

Posted by

CNL

at

2:44 PM

![]()

Thursday, June 14, 2007

MVIS Update

I bought more December $5.00 MVIS calls for $1.00 today and yesterday. To me these are by far the cheapest of the options due to the fact they are in the money and have nearly half the year left before expiration.

Posted by

CNL

at

7:06 AM

![]()

Wednesday, June 13, 2007

Reflections - Microvision 2007 ASM

Microvision's annual 2007 meet was everything I expected and more. I didn't anticipate a huge turn out for this 250 million dollar micro cap. Sure they have received significant coverage as of late from the likes of The Wall Street Journal and Business Week, but to the bulk of Wall Street, Microvision Inc. is nearly transparent. This was exceedingly apparent as I signed in and received my shareholders pamphlet. Not many people in attendance. That being said, one could still sense the excitement contained within.

Microvision's annual 2007 meet was everything I expected and more. I didn't anticipate a huge turn out for this 250 million dollar micro cap. Sure they have received significant coverage as of late from the likes of The Wall Street Journal and Business Week, but to the bulk of Wall Street, Microvision Inc. is nearly transparent. This was exceedingly apparent as I signed in and received my shareholders pamphlet. Not many people in attendance. That being said, one could still sense the excitement contained within.

I started my tour at the Heads-Up Display(HUD), incidentally bypassing the RoV display completely. In its current form the HUD creates a 'laser pointer' image i.e. GPS, MPH and various logistic information is simply displayed into your field of vision in a vibrant red hue. I was told by the staff future generations will include color. The image was incredibly clear and interestingly remains in focus even if you look past it. Basically, reading and conceptualizing the information presented by HUD requires little effort on the part of the viewer. I eventually left the Heads-Up Display after the PicoP dark room caught my eye.

I walked into the dark room to find it teeming with enthused investors and engineers. It didn't take long for me to hone in on all the excitement. Centered in the room was a table with both of Microvision's prototypes PicoPs eloquently projecting crystal clear video footage of everyone's favorite Pixar fish. While the image clarity was nearly identical in the two prototypes, the latest generation, presented in wide angle WVGA resolution provided a superior viewing experience. Mind boggling to me, this all occurred in less than half a year and yet Microvision was able to maintain 1.5 W usage and nearly a 7mm package. Hmmm

Needless to say it was quite shocking seeing these projectors for the first time. I didn't really grasp it initially due to my fixated on the projection, but finally I looked down and realized just how minuscule these projectors are!

To me the speckling artifact was noticeable on both projections. However, a investor near me chimed in, "Hey nice water effect." An engineer laughed and quipped, "Actually that's an inherent artifact of the laser based scanning technology." He went on to describe the physics behind it, but I wouldn't do it justice attempting to transcribe it here. He also mentioned how they were currently working on dampening this effect by deceiving our eyes of its presence. Essentially, the artifact would remain, but we would have greater difficulty identifying it visually. Personally, the speckle effect isn't like a typical imaging artifact. Instead of distorting the image it merely creates a shimmering effect, that is if you focus on it. I found as I watched Nemo swim, the effect became less apparent as my eyes simply "looked through" the effect. In retrospect its rather difficult to qualify.

Due to time constraints I will end here. In conclusion I will say that this technology's potential is massive. Weather in the form of RoV, PicoP or HUD, Microvision's prototypes are years ahead of the nearest competitor with respect to power requirement, size, and image quality.

At this point I refuse to get into future profitability, margins etc. In time these will become an issue. Currently they are irrelevant. For now I am going to treat my investment in MVIS as a biotech investment, highly speculative with potential for astronomical gains. As long as MVIS and most importantly Tokman, continue to set and reach future mile stones, I believe shareholder appreciation will continue. On that note I will leave with several video clips from the meeting.

Comparision between January and May 2007s PicoP

Live action footage.

854x480

Yes it is THAT small.

Posted by

CNL

at

7:59 PM

![]()

Tuesday, June 12, 2007

Microvision 2007 Annual Shareholders Meeting

Tomorrow June 13th. Doors open at 8:00 am with demonstrations starting at 9:00. My plan is to get some pictures and video footage from the meeting and post them here accompanied with some observations. More on this later!

Posted by

CNL

at

7:38 PM

![]()

Monday, June 11, 2007

Update LTD NBF

Production at the plant, which has a capacity of 20 million gallons per year and sits on a 3-acre lot on the north side of DeForest, has been low as it tests its equipment. But Read expects the plant to produce 60,000 gallons per day by the end of June.

In other action I ended up buying some LTD July $25.00 put options today for $.40. While this puts me at odds with a recent Barron's article, I feel that short term volatility, weakening technicals and strengthening bond prices favor near term bearish sentiment.

Posted by

CNL

at

6:25 PM

![]()

Sunday, June 10, 2007

Charting Stocks - MVIS LTD GPS ANN

Posted below are some charts of stocks I will be watching this week and possibly initiating a position in. My focus was on weak equities, which are currently under performing the S&P. As I have posted before, I have been looking for weak stocks to hedge my portfolio against the possibility of a market downturn. Aside from some short options, I also included a revised weekly chart of MVIS. This stock continues to outperform on a technical basis.

All I can say is wow.

Posted by

CNL

at

10:12 PM

![]()

Friday, June 8, 2007

Thursday, June 7, 2007

Looking For Potential Shorts

All I can say is yikes! That being said I will be looking for shorting opportunity's and quite possibly selling my WFR call options I bought today. The market is looking worrisome. Especially the increasing volume appreciated across the board. Remember volume precides price. And in an uptrend its soothing to see higher volume on accumulation days. Some possibilities might be GS and WWW.

Posted by

CNL

at

10:45 PM

![]()

Updates - WFR ADM MVIS

For starters I sold all of my ADM July $35.00 put options at $1.90 and $1.70 for a gain of 61.9% 80.5% respectively(pre tax/fees). I will continue holding my September $30.00 put options to leverage myself towards continued ADM weakness. Currently they are nearing over sold levels and in need of a bounce.

With a portion of my profits I loaded up on some WFR July $65.00 call options for an average price of $1.10. Technically, the stock held the bottom trend line on the daily time frame. While this is important, it is even more important we appreciate a bounce in the near future in order to continue the uptrend(originating on early May).

The rest of my profits were used to buy MVIS September $7.50 calls for an average price of $.25. This is a highly speculative play, which if successfully will mark a 32% increase in share price(market close today - $5.68).

Posted by

CNL

at

6:33 PM

![]()

BUY WFR / SELL ADM

In at $1.10 for the July $65.00 call options on WFR. Apparently, support was found at the bottom trend line. I also sold a portion of my ADM call options. More on this later.

Posted by

CNL

at

8:59 AM

![]()

Wednesday, June 6, 2007

Keeping an Eye on WFR

The quote below was taken from Yahoo! Finance; It referances to the strait's significance in relation to the global oil economy. My concern would be with respect to general market weakness at this point. Regardless, I will be eyeing the June $60.00 calls.

Below are several charts which illustrate my point. Its important to remember that support strengthens when it accumulates on multiple time frames.

Posted by

CNL

at

11:07 PM

![]()

Tuesday, June 5, 2007

Update ADM

Apparently, ADM found near term support simultaneously at the 38% fibonacci retracement and the February 1st gap up. Regardless, the stock is still in a marked downtrend during a bull market and this guy continually rates the stock as a triple sell. While I infrequently rely in Cramers haphazard stock picking, his influence shouldn't be completely ignored. These developments lead me to believe that the support ADM found will be short lived.

Apparently, ADM found near term support simultaneously at the 38% fibonacci retracement and the February 1st gap up. Regardless, the stock is still in a marked downtrend during a bull market and this guy continually rates the stock as a triple sell. While I infrequently rely in Cramers haphazard stock picking, his influence shouldn't be completely ignored. These developments lead me to believe that the support ADM found will be short lived.

Posted by

CNL

at

6:50 PM

![]()

Monday, June 4, 2007

Cal Dive International Inc.

I bought some July $17.50 call options for Cal Diver International Inc.(DVR). I will have more reguarding this company hopefully later in the week.

Sold the remainder of my June $5.00 MVIS call options at $.60 today for a gain of 233%.

Finally, ADM gapped down in early traded today, but was able to find support at the $34.00 level. I mentioned on Friday that the stock might find some short term support at this level.

Posted by

CNL

at

12:39 PM

![]()

Friday, June 1, 2007

Fun Friday

There was a great piece out yesterday in the New York Times highlighting general market sentiment and comparing current P/E market valuations to their historical averages.

There was a great piece out yesterday in the New York Times highlighting general market sentiment and comparing current P/E market valuations to their historical averages.

Many people want to target this market as top heavy and in dire need of a correction, but the uptrend is intact and thus should be followed. Listed below is a quote I found most interesting.

Still, many market specialists note that even with the recent run-up in the stock market, American companies are cheap compared with the past and with other world markets. The price-to-earnings ratio for companies in the S.& P. is about 18 today, compared with 32.8 in 2000 and a 21-year average of 22.5.

As for my recently purchased put options, ADM continues to under perform while the market chugs higher. Most importantly, ADM was unable to surmount the pivotal 200 DMA yesterday. Due to this development I am all the more confident with my options. It should be noted that possible support exist at $34.00.

Posted by

CNL

at

4:44 PM

![]()